Preparing to Buy a Self Storage Facility

Making the Right Investment Strategy

Are you preparing to buy a self storage facility? In the last few years, self storage has become an increasingly popular investment, in great part because returns over the last 15 years averaged 15.43% per year. Compared to some investments, self storage also seems easier to understand, with less moving parts. Additionally, self storage development has become more popular over the last few years, since the prices for existing facilities will continue to rise as demand for individual units increases.

With approximately 83% of self storage facilities owned by “Mom & Pop” operators, new listings are always coming into the market. That being said, a continuing trend in self storage is consolidation, with REITs owning 8% of self storage and mid-size operators holding 9%. Before more of the individual facilities are absorbed by self storage chains, now is the time to buy a facility.

If you want to buy a self storage facility, having an investment strategy in place is paramount. Oftentimes a property might be a sound investment for someone else, but one that you’d be better off ignoring.

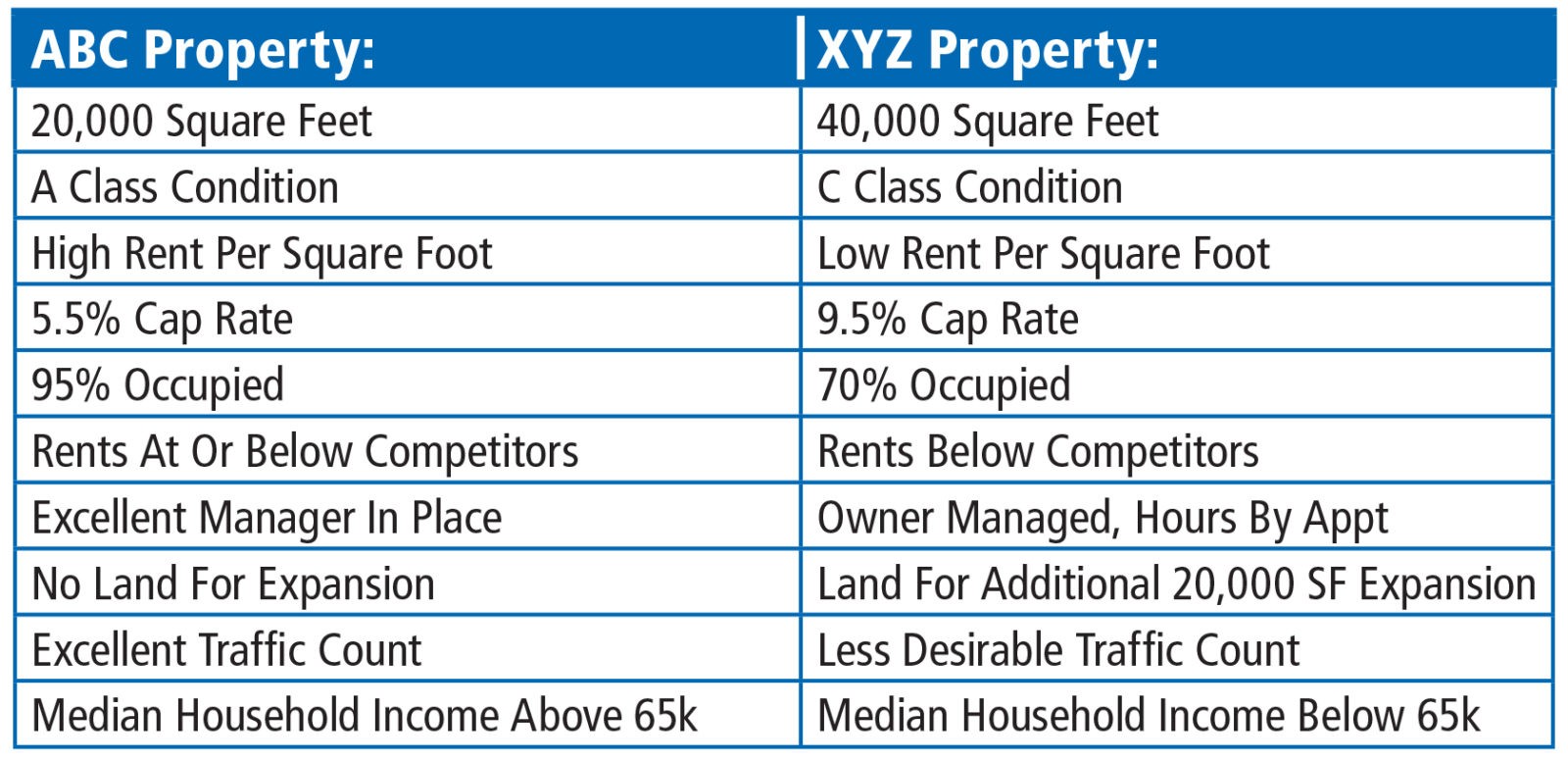

Let’s look at two example properties, assumed to be the same price:

Cap Rate is the return on investment (after expenses) that a buyer would receive if they paid all cash for the property. In other words, the net operating income (all income minus expenses) divided by the sales price equals the cap rate. So on ABC Property, if the buyer paid all cash, they would receive a 5.5% return on investment. XYZ Property offers a return of 9.5% for an all cash buyer. The more you pay for a property, assuming the net operating income stays the same, the lower of a return on investment (i.e. the cap rate.) Conversely, the less you pay for a property, the higher the return.

So it seems like an easy choice: buy XYZ Property, with the higher return on investment. All you need to do is put new doors in, hire a quality manager, implement basic operation best practices, reduce vacancy, raise rents to competitor levels, and build out the expansion. Simple, right?

Well, while many management practices are relatively easy to understand (maintain an online presence, collect past due rent, offer rent concessions to acquire tenants, set up a tenant rate management program,) implementation of these practices is typically time-consuming and stressful. If you’re buying XYZ Property at 70% occupancy, and you have to begin the eviction process on 20% of the property, you might see your occupancy drop to 50% before it goes back up again.

Additionally, ABC type properties are much easier to sell than XYZ ones. The buyer pool for ABC properties typically have more available cash, and can borrow at lower rates. If you buy XYZ Property with the plan of improving management to significantly improve value, and selling to cash in on your work, you may find it very hard to sell your property, especially if the overall market is not favorable.

One other investment strategy that’s not uncommon is to buy properties in C Class condition and physically improve them to A Class condition. This improves value in two ways: it raises rents that the market will support for your property and lowers the cap rate your property would sell at. This strategy requires construction know-how, and is capital-intensive, but can be very lucrative if done right. It’s very similar to “flipping” a house in some ways, such as cosmetic and system improvements to a property (such as repainting the buildings, installing an electronic gate system, or installing HVAC to convert units to climate controlled,) but it also potentially repositions the property through techniques like improving road-front visibility (i.e. through getting a variance to clear trees from in front of the building.)

There are endless variations of these strategies, and they’re all excellent ways to improve the value of a self storage property. Determining which strategy is right for you will depend upon your available time, cash, and risk aversion. Picking a strategy is the first step in buying a property, since having an investing plan will help you quickly evaluate and make decisions on properties as they come onto the market.

If you’re ready to buy a self storage facility or are interested in selling yours, contact us today and we will be glad to help you reach your goals. You can also request a Free Property Valuation of your self storage property at any time.

This article has been published by Inside Self Storage and can be seen here.