GUEST BLOG: Gifting Strategies for Business Owners

Submitted to Investment Real Estate by Kieran McLaughlin at Valley Forge Financial Group, Inc.

Proactive estate planning is paramount for families with large estates and significant allocations to illiquid assets such as a family business and private real estate; self storage facility for example.

Under current law, the Federal lifetime gift/estate tax exemption for an individual is $11,180,000 ($22,360,000 for a married couple). Assets up to the exemption amount can be gifted during life or passed upon death free of estate taxes. Assets transferred in excess of the exemption are subject to a maximum federal gift/estate tax rate of 40%.

For wealthy families with illiquid estates, the estate tax can be especially onerous. For example, in 2018, a married couple with a net worth of $45,000,000 would owe $15,804,000 in federal estate tax upon their passing. If the bulk of the estate is comprised of real estate or a family business, executors may be forced to quickly sell assets in order to provide needed liquidity for estate taxes.

Fortunately, business owners and high net worth families have a variety of options at their disposal to limit the impact of estate taxes and ensure the execution of their wealth transfer objectives.

Lifetime Gifting

A lifetime gifting strategy can be utilized to reduce future estate tax liability and maximize estate tax-free appreciation of assets. Gifting might also be motivated by non-tax reasons such as a donor’s desire to see children or grandchildren enjoy his or her wealth.

A family can utilize all or a portion of their federal exemption ($22.36MM for a married couple in 2018) as well as Annual Exclusion Gifts, which are “free” annual gifts of up to $15,000 per donee that are not counted against the lifetime exemption. In most cases assets are gifted to a trust. Utilizing a trust ensures assets will ultimately be distributed per the donor’s wishes and shields beneficiaries’ interests in the trust from creditors. Examples of common gifts include: cash, marketable securities, investments in real estate or private equity such as self storage, or interest in a family business. Cash or income-producing assets transferred to a trust might also be used to fund life insurance, which can be used to provide liquidity for estate taxes or augment an inheritance.

Closely held corporations, partnerships and limited liability companies possess several advantages from a gifting standpoint. The ability to structure these entities to have controlling/non-controlling interests allows for donors to gift passive interest while retaining control over operations. Further, since donees do not possess control or voting rights, the interest is eligible for valuation discounts for gift purposes.

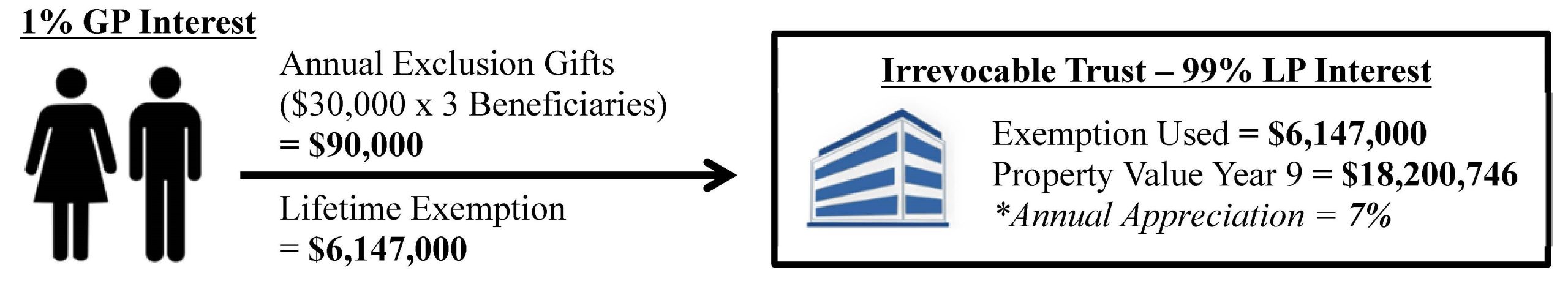

The following example illustrates how a family might utilize a gifting strategy. Mr. and Mrs. Smith would like to transfer interest in a family limited partnership that owns an investment property, such as a self storage business, worth $10,000,000 to a trust for the benefit of their three children. Mr. and Mrs. Smith are each 0.5% General Partners and 49.5% Limited Partners of the FLP.

After an appraisal, a 37% valuation discount on the limited partnership interest is deemed appropriate due to lack of control and marketability.

Mr. and Mrs. Smith utilize a portion of their lifetime exemption and annual exclusion gifts to transfer the 99% limited partnership interest to an irrevocable trust. For simplicity, it is assumed the gift is made in one year, although it would likely be spread over several years to leverage annual exclusion gifts.

By utilizing a gifting strategy, the donors are able to significantly leverage a portion of their lifetime exemption. Further, by retaining 1% GP interest, the donors retain control of the entity.

Sale to Intentionally Defective Grantor Trust (IDGT)

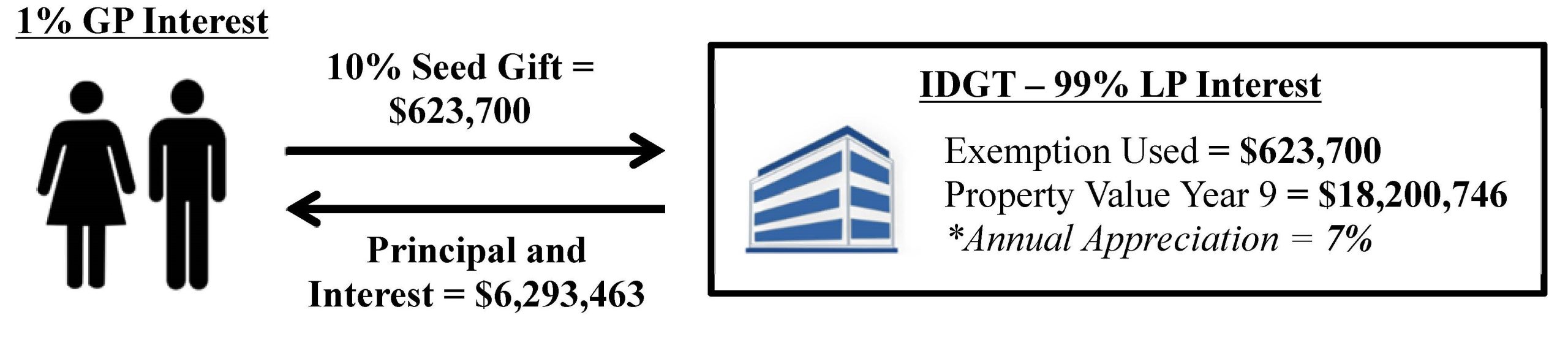

Rather than outright gifting, a donor might also consider selling assets to a trust. A common technique is an installment sale to an Intentionally Defective Grantor Trust (IDGT – pronounced “IDIT”). An IDGT is effective for estate tax purposes, meaning that the assets held in trust will be shielded from future estate taxes, but defective for income tax purposes – the grantor is responsible for income taxes owed by the trust.

Overview:

- Grantor sells assets to IDGT in exchange for a promissory note, typically 9 years.

- Requires 10% seed funding.

- Interest rate set at §7872 rate applicable to term of note (Current Mid Term Rate = 2.57%).

- Payments to Grantor can be amortized over note term or structured as interest only with balloon payment.

- Appreciation of asset in excess of §7872 rate (AFR) passes to IDGT beneficiaries free of estate tax.

To illustrate, Mr. and Mrs. Smith will sell the 99% LP interest (valued at $6,237,000 after discounts) to an IDGT for the benefit of their children, using a 9 year note with an annual interest rate commensurate with the mid-term AFR (2.57%).

Utilizing a sale to the IDGT allows for the grantors to transfer the same asset while using a far lower portion of their lifetime exemption ($623,700 versus $6,147,000).

Advantages:

- Appreciation in excess of §7872 rate (mid-term AFR) passes to trust beneficiaries free of estate taxes. IDGTs are particularly advantageous in a low interest rate environment due to a lower ‘hurdle’ rate.

- Grantors retain income during note period.

- No capital gains tax on assets sold to IDGT.

- Since the IDGT is intentionally defective for income tax purposes, the grantors are responsible for the trust’s income tax obligation – tax payments made on behalf of the trust are effectively “free gifts.”

IDGT Considerations

The grantor’s death before the note is fully repaid causes the note balance to be included in the estate. A Self-Cancelling Installment Note (SCIN) can be used as a hedge against risk of premature death. Should the grantor pass, the SCIN allows for the automatic cancellation of the note, excluding the balance from the grantors’ estate. A SCIN requires a risk premium – either a higher interest rate or increased principal. The risk premium is calculated using IRS mortality tables. SCINs may be advisable if the transaction is taking place close to the grantor’s life expectancy.

If you have questions about self storage gifting strategies and would like more information, you can visit VFFG’s website or contact Kieran directly at 484-679-4040 or via email at kmclaughlin@vffg.com.